- November 30, 2022

AgVend Introduces Point-of-Action Financing in Its Digital Enablement Platform

Ag retailers can now deliver an embedded digital financing experience within their AgVend-built grower portal.

November 30, 2022; Austin, Texas – AgVend, the leading digital enablement solutions provider, announced today the release of its enhanced financing offer, AgVend Digital Financing. Ag retailers can now provide their grower customers with a more-convenient, integrated financing option right within their AgVend-built Grower Portal.

AgVend Digital Financing gives third-party finance providers the ability to take full advantage of AgVend’s digital enablement solution by making services more accessible and available at a retailer’s digital point of sale.

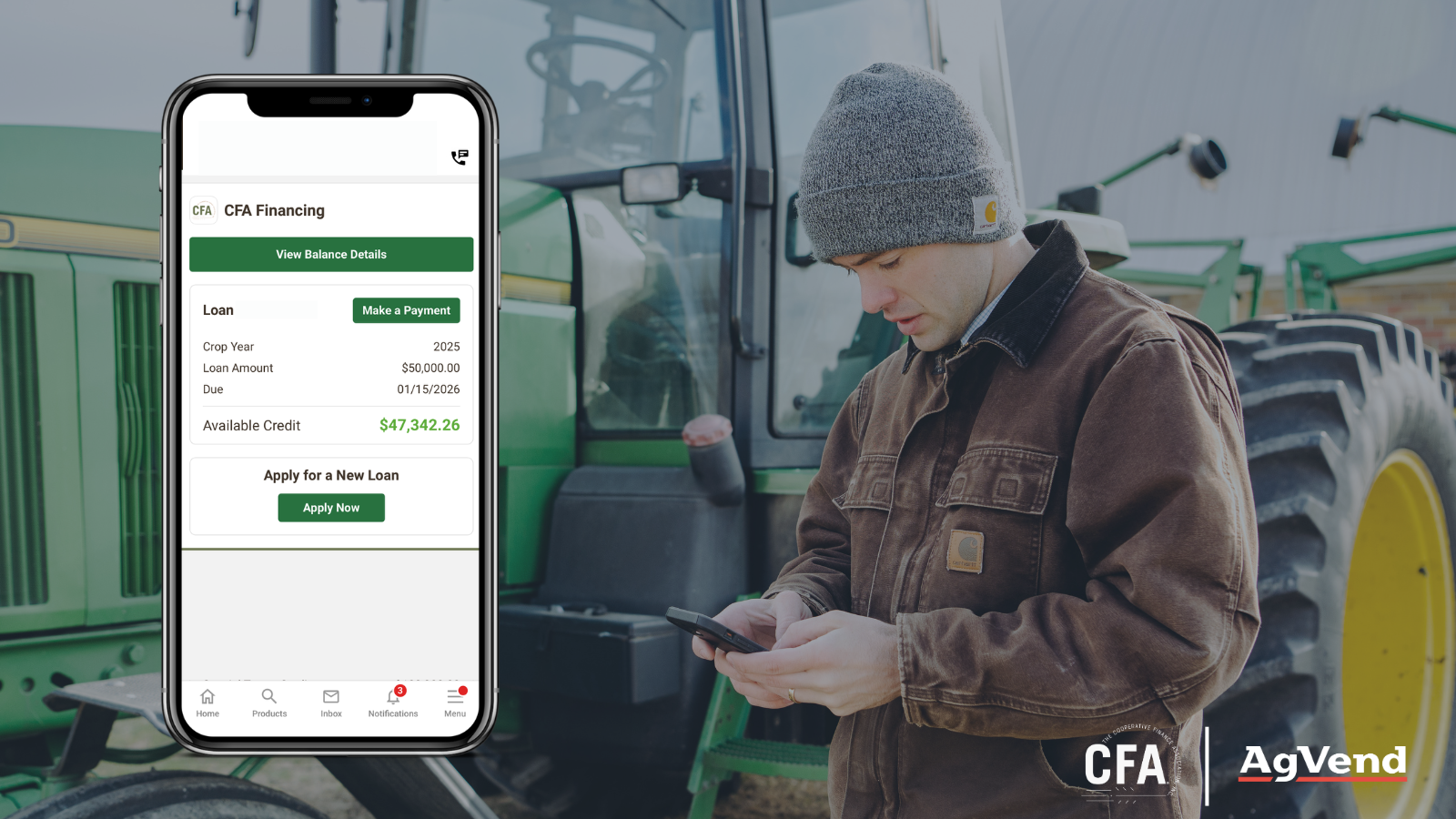

Growers can apply for loans faster, use the line of credit as a payment method, and repay loan balances–all within the same digital enablement platform they use every day.

“We have decided to add another feature to our AgVend-built portal to enhance our customer’s experience of easily doing business with Asmus Farm Supply,” said Harlan Asmus, CEO of Asmus Farm Supply. “We now offer customer purchase financing, branded under our name. The tool is easy to use and will provide multiple benefits to both our customers and our company.”

Because AgVend Digital Finance integrates financing options into retailers’ online portals, retail teams gain increased visibility into customer finance levels so they can have more strategic conversations instead of collecting loans and managing paperwork.

The first AgVend Digital Finance integration partners will offer end-to-end financing available through Compeer Financial as the service provider and Evergreen Bank Group as the lender of record. This partnership enables retailers:

- Branded experience: Add a white-labeled finance program to the services they provide while reducing back-office overhead

- Fast and actionable: Make digital loan applications accessible within their online portals so growers can apply quickly for loans

- Convenient: Give growers a financing option they can use directly in the portal for all agronomy inputs, services, and energy purchases

“With AgVend, we really saw an opportunity to simplify finance solutions ag retailers can offer to their customers,” said Darin Campbell, President and CEO at Evergreen Bank Group. “The ability for retailers to white-label their finance offer and provide a unified experience within their online portal helps retailers enhance digital experiences, but also deliver fast and actionable financing options to growers. That’s a win for all parties involved.”

AgVend partners with third-party providers to connect core business systems that integrate with AgVend’s Digital Enablement Platform. Compeer Financial and Evergreen Bank Group are two of many providers in the AgVend Integration Ecosystem, which includes ERP, agronomy, grain, energy, and finance systems.

“We are relentlessly focused on delivering solutions that help our Partner Retailers strengthen their customer relationships,” said Alexander Reichert, CEO and Co-Founder of AgVend. “AgVend Digital Finance demonstrates the extensibility of digital enablement solutions and how they can scale and evolve to give our partners and their growers the digital experience they need.”

AgVend Digital Finance is an extension of finance capabilities that AgVend launched in 2020, which gives retailers and growers the ability to see up-to-date loan balances across providers. Other finance partners in the AgVend Integration Ecosystem include John Deere Financial, Growers Edge, Cooperative Finance Association, and WinField United SECURE.

About AgVend

AgVend is the leading digital enablement solutions provider in agribusiness. The industry’s most innovative ag retailers use AgVend’s white-labeled solutions to empower their teams, enhance visibility, and exceed customer expectations. The AgVend team brings decades of experience in agriculture, digital marketing, and enterprise software for the Fortune 500. Headquartered in Austin, TX, AgVend operates a distributed organization model with local coverage in all major U.S. and Canadian ag regions.